Frozen Crypto has become a real concern since 2025. More people are dealing with locked wallets, blocked withdrawals, or tokens they suddenly can’t move. It’s happening across exchanges, blockchains, and even smart contract–based projects as rules tighten and scams grow more sophisticated.

If your coins ever get stuck, it helps to understand why it happens and what you can realistically do. Freezes today can come from compliance checks, legal action, suspicious transfers, or even built-in token controls. Sometimes it’s temporary. Sometimes it’s a sign of a bigger issue.

This guide walks you through how crypto freezing works, why it happens, how to fix it, and how to stay safe. Everything here is based on the latest 2025 trends, updated rules, and real cases from exchanges and blockchain analytics teams.

Understanding How Crypto Wallet Freezing Works?

A lot of people still think blockchain assets can’t be touched, but that’s only partly true. Crypto stored on centralized platforms can be frozen instantly because the exchange controls the private keys. On-chain assets are different, yet many modern tokens include blacklist functions or admin controls that let issuers halt transfers if they detect fraud or receive a legal request.

Stablecoins, wrapped assets, and some Layer-2 tokens now use compliance layers that make freezing easier than it was a few years ago. By mid-2025, major chains like Ethereum, Tron, and several EVM networks will cooperate more closely with investigators. That means wallet freezes at the smart-contract level happen more often than before.

Smart contract freezes are especially common in the DeFi space, where some projects include built-in blacklist functions. If you want a deeper look at how risky DeFi setups enable these freezes, DeFi Scams guide helps break it down.

Why Exchanges Freeze Assets?

Exchanges freeze funds for a few common reasons. Most cases involve suspicious activity, risky deposits, or mismatched KYC details. When regulators or financial intelligence units request information, exchanges often react by blocking withdrawals until the review is finished.

Some freezes are automated. If your transactions look unusual or come from a flagged wallet, systems mark your account for manual review. Until that clears, your crypto sits locked.

When Law Enforcement Steps In?

Police agencies can request a freeze when they believe funds are connected to fraud, stolen assets, or money laundering. These orders often come from cybercrime units or financial regulators. Once an order is issued, exchanges have to follow it.

Cross-border cases have increased sharply. Interpol, Europol, the Indian FIU, FinCEN, and other agencies now share data much faster than before. That means wallets tied to scams can get flagged across multiple platforms in a single day.

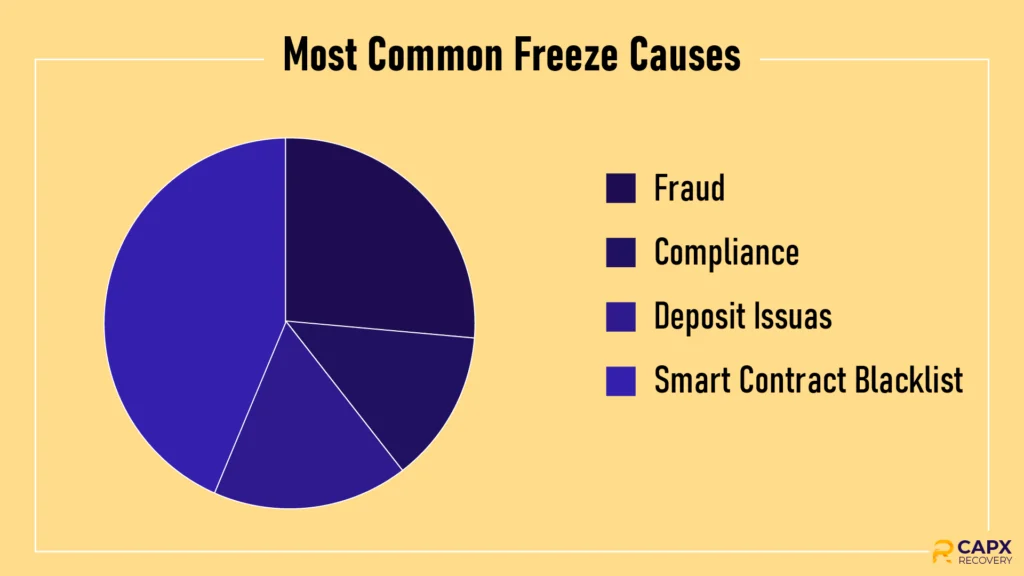

Common Reasons Crypto Wallet Gets Frozen

Most freezes today are linked to fraud cases. Scammers use fast-moving wallets to hide stolen funds, and exchanges rely on blockchain analytics tools to trace those movements. When a wallet gets flagged, anything connected to it can be frozen until investigators sort things out.

Romance scams, fake investment platforms, and pig-butchering schemes are the main drivers. Reports of crypto-related fraud continued to rise through 2024 and 2025 as scammers shifted to stablecoins and high-volume chains, prompting exchanges to become even stricter about freezing assets early.

Many of these wallets belong to organized fraud groups. To gain a deeper understanding of how these actors operate, consider this breakdown: Who Are Cybercriminals?

Chargebacks or Suspicious Deposits

If someone deposits funds into an exchange using a bank account or card, and that payment later gets reversed, the exchange often locks the linked crypto to prevent loss. Even if the chargeback wasn’t your fault, your account can still get pulled into the review. This is one of the most common reasons new users see their accounts restricted.

Incorrect KYC or Flagged Activity

Small inconsistencies in identity documents, location changes, or mismatched personal information can trigger a freeze. Some platforms also block withdrawals if they detect login attempts from unusual regions or VPNs. Until you clear the compliance check, funds stay stuck.

Smart Contract or Network-Level Freezes

Some tokens come with administrative controls that allow issuers to stop transfers from specific wallets. This is common with stablecoins, wrapped assets, and newer compliance-focused projects. If your wallet gets blacklisted at the contract level, the freeze applies directly on-chain, not just inside an exchange.

How to Tell if Your Crypto Wallet Is Frozen?

A frozen wallet isn’t always obvious at first. The signs depend on whether the freeze happened on an exchange or at the blockchain level.

Common indicators include withdrawals that won’t go through even though your balance shows as available. Some users see their transactions stuck in a pending state with no confirmations, while others get error messages from the smart contract saying transfers are restricted. Exchanges usually send an email or in-app alert asking for verification, but sometimes the notice appears only when you try to trade or withdraw.

If you can’t move funds and nothing looks wrong on the network, the freeze is likely coming from the platform holding your coins.

What To Do When Your Crypto Is Frozen?

Start by finding out who applied the freeze. Check your email inbox, spam folder, and in-app notifications for messages from the exchange. Look for compliance alerts, KYC requests, or warnings about suspicious transactions.

If you’re using a self-custody wallet, check the token’s contract page on a blockchain explorer. Some tokens display a clear flag showing that transfers from your address are restricted.

Work With Customer Support

Most freezes on exchanges are temporary and clear once you provide the right information. Support teams usually ask for identity documents, proof of funds, screenshots of transactions, or bank statements that match your deposits.

Reply with complete information in one go. Slow or incomplete responses often stretch a review from a couple of days to several weeks. Keeping your tone calm and factual helps the process move faster.

When to Involve Law Enforcement

If your crypto was frozen because it’s tied to a scam, theft, or unauthorized transfer, it’s worth filing a report with your country’s cybercrime unit. Provide wallet addresses, transaction IDs, chat logs, screenshots, and any details that show how the funds moved.

Global agencies like Interpol and local cyber cells share data much faster in 2025, which improves the odds of tracing funds or confirming a freeze order. Having an official report also strengthens your case with exchanges.

Work With a Crypto Recovery Specialist

Recovery experts can help when funds are tied up in complex fraud cases or cross-border disputes. Legitimate specialists use blockchain tracing, legal coordination, and formal requests to push exchanges or token issuers to act.

Just be careful. Many fake recovery services promise instant unfreezing or guaranteed refunds. Real specialists never ask for upfront fees in crypto, never use personal emails, and always work through documented processes.

If you want to see how professional recovery teams approach scam-linked freezes, this cryptocurrency scam recovery service provides a clear overview.

How to Recover or Unfreeze a Frozen Crypto Wallet?

Most freezes on exchanges are tied to compliance checks, so the solution is usually straightforward. Fix any mismatched KYC details and submit the documents they request. If the issue came from a risky deposit or a flagged transaction, you may need to provide proof of where the funds came from.

Once the review clears, exchanges restore your withdrawal rights. Some platforms take a few hours, while more complex cases can run for several days.

Unfreezing Smart Contract or Token-Level Freezes

If the freeze happens on-chain, the issuer or project team controls the unlock. You’ll need to reach out to them, explain the situation, and verify your identity. Some teams also require a police report if the freeze was tied to suspected fraud.

Contract-level freezes take longer to resolve because the project has to update the blacklist or push a transaction that lifts the restriction.

When Assets Cannot Be Unfroze

Some freezes are permanent. This usually happens when law enforcement seizes the assets as part of a criminal investigation. Tokens can also stay locked if the project rugged, abandoned its contract, or intentionally blacklisted the wallet with no reversal option.

In these situations, even exchanges or recovery experts can’t unlock the funds.

Scams Involving Frozen Crypto Wallets

Freezes have become a convenient excuse for scammers. Many victims only realize they’ve been tricked after someone claims their wallet is locked and asks for money to unblock it. These schemes often copy the language of real exchanges or law enforcement agencies, which makes them harder to spot.

Fake Recovery Services

Scammers pose as experts who can unfreeze your crypto for a fee. They promise fast results or inside access to exchanges. Once you pay, they disappear. Real recovery professionals never guarantee outcomes or ask for crypto upfront.

Phishing and Fake Support Teams

Fraudsters create fake support chats, emails, and websites that look like official exchange help pages. They ask for seed phrases, passwords, or remote access to your device. Sharing these details gives them full control of your wallet.

These scams rely heavily on social manipulation. Understanding how social engineering works in the crypto world is a key step in staying safe from crypto fraud and manipulation.

Criminals often use the same psychological tactics seen in other online frauds, and this guide breaks down those methods by examining cybercriminal behavior and common manipulation techniques.

Impersonation of Law Enforcement

Some scammers pretend to be from cybercrime units or financial regulators. They send fake freeze notices and demand verification fees or case-processing charges. Real agencies never ask victims for payment to release funds.

Ransom and Unlocking Fees

If you’re told to pay a release fee or “unfreezing tax,” it’s almost always a scam. Exchanges don’t charge unlock fees, and on-chain freezes cannot be lifted with a simple payment.

Red Flags to Watch For

| Red Flag | What It Means | Why It’s Dangerous |

| Requests for seed phrases | Trying to take over your wallet | Gives full access to funds |

| Demands for upfront fees | Fake recovery service | You lose money immediately |

| Emails from unofficial domains | Phishing attempt | Can lead to stolen accounts |

| Claims of guaranteed recovery | False promise | Real recovery is never guaranteed |

| Pressure to act quickly | Scam tactic | Prevents you from verifying the source |

How to Protect Yourself From Frozen Wallet Issues?

You can’t prevent every freeze, but you can lower the chances. Most problems come from compliance gaps, risky transfers, or interacting with the wrong platforms.

Use exchanges that follow clear regulations and keep your account information updated. Avoid mixing funds from unknown sources, and stay careful with wallets that have touched suspicious addresses. If you move money between platforms, keep a simple record of where it came from so you can prove it later.

Freezes tied to scams typically begin with fake websites, unrealistic promises of quick returns, or unsolicited messages. Stick to official apps, verify links, and avoid any service that asks for private keys or remote control of your device.

For a straightforward guide on identifying and reporting suspicious activity, refer to this complete cryptocurrency scams guide that explains how to spot, report, and recover from fraud.

Trends in Crypto Freezing, Compliance, and Asset Recovery

Crypto oversight has tightened across most major markets by 2025, and that shift shows up directly in how and why wallets get frozen. Exchanges now rely heavily on real-time analytics to flag risky activity, which means even small inconsistencies can trigger temporary holds. This isn’t always a bad sign. Most freezes clear once users verify their details or explain where the funds came from.

One big change is how fast agencies now work together. Cross-border investigations used to take months. With updated data-sharing systems between Interpol, Europol, FinCEN, the UK’s NCA, and India’s FIU, freezes connected to fraud are issued far more quickly. That coordination has helped seize larger amounts of stolen crypto each year. Chainalysis and similar firms noted steady growth in successful takedowns across 2024 and into 2025, especially involving stablecoin transactions. Many of these freezes begin with the same DeFi and crypto scam trends that we break down in our article on decentralized finance scam patterns.

Recovery efforts have also improved. More law firms and forensic teams now specialize in tracing stolen assets, and exchanges are more open to working with them. At the same time, compliance-driven freezes have become more common because platforms want to avoid penalties. This means more honest users experience short-term holds, but overall, it has made fraud harder for criminals to hide.

Exchange Freezes vs Blockchain Freezes vs Scam-Triggered Freezes

| Type of Freeze | What Triggers It | Who Controls the Freeze | How Long It Usually Lasts | How to Fix It | Recovery Chances |

| Exchange Freeze | Suspicious activity, KYC issues, risky deposits, legal requests | Centralized exchange | Hours to a few days for simple cases; longer if tied to investigations | Submit documents, fix KYC, provide proof of funds | High if you cooperate and the case is genuine |

| Blockchain Freeze | Smart contract blacklist, token issuer action, stablecoin compliance rules | Token issuer or contract admin | Can be days, weeks, or permanent depending on the reason | Contact the issuer, verify identity, provide evidence | Moderate; depends on contract controls and issuer’s decision |

| Scam-Triggered Freeze | Fake alerts, phishing messages, fake support teams | Scammer, not a real platform | Until the victim realizes it’s a scam | Stop contact, secure accounts, report the scam | Low; funds are often already moved |

Key Takeaways and What This Means for You

Frozen crypto is stressful, but most situations have a clear path forward once you understand what triggered the issue. A freeze doesn’t always signal wrongdoing. Many cases are simply compliance checks or misunderstandings that clear up once you verify your details.

Staying proactive helps. Use platforms that follow proper regulations, keep your information updated, and avoid risky transfers or unknown wallets. If something ever feels off, act quickly, ask questions, and rely only on official support channels. With the right steps, you can keep your assets safer and navigate the process with confidence. If you want to learn how to spot crypto fraud and recover your losses, our cryptocurrency scams guide explains everything in simple terms.

FAQs

How long does a crypto freeze usually last?

Most compliance reviews clear within a few days once you provide the right information. Cases tied to fraud or legal orders take longer because multiple agencies may be involved. The timeline depends entirely on the reason behind the freeze.

Can frozen crypto be recovered?

Yes, in many cases, you can recover access once the issue is verified. If the freeze is due to a mistake, KYC mismatch, or flagged deposit, exchanges usually unlock the funds. Recovery is harder when the freeze is part of a criminal case or the token issuer refuses to reverse it.

What should I do if an exchange falsely flags my account?

Reach out to support, explain the situation, and submit any documents they request. Providing clear proof of funds often speeds up the review. Keep records of your deposits and transfers so you can respond quickly.

How do I know if a recovery service is real or a scam?

Real experts never ask for seed phrases, never guarantee results, and don’t demand upfront fees in crypto. They work through documented channels and can explain their process clearly. If someone pressures you, uses a personal email, or claims they can unlock funds instantly, it’s a scam.