Crypto withdrawal fee scams are one of the fastest-growing fraud patterns in crypto right now. The pitch sounds simple and believable. Your funds are visible, but you need to pay a small fee to unlock or process the withdrawal. Once the fee is paid, nothing moves. Instead, a new issue appears, and another fee is demanded.

These scams exploded alongside fake exchanges, impersonated wallet support, and private investment groups. In early 2026, regulators and consumer agencies continue to flag advance-fee crypto fraud as a top loss driver, especially for retail users. What makes this scam dangerous is how close it looks to real crypto mechanics. Networks do charge fees, and withdrawals can fail. Scammers exploit that gray area.

This guide breaks down how crypto withdrawal fee scams work, the warning signs most victims miss, real-world examples, and what recovery options realistically exist after funds are sent.

What Is a Crypto Withdrawal Fee Scam?

A crypto withdrawal fee scam is a form of advance-fee fraud where victims are shown a fake or manipulated crypto balance and told they must pay a fee before withdrawing their funds. The balance looks real. The platform looks functional. But the funds never existed or were never under the victim’s control.

The scam usually happens on fake exchanges, cloned trading websites, or through impersonated wallet support. After a user deposits crypto or believes they have earned profits, the withdrawal suddenly gets blocked. The reason sounds technical and urgent. Liquidity fee, network unlock, tax clearance, compliance verification, and gas fee upgrade.

The key detail is this. Legitimate platforms deduct fees automatically from your balance. Scammers ask you to send more crypto first.

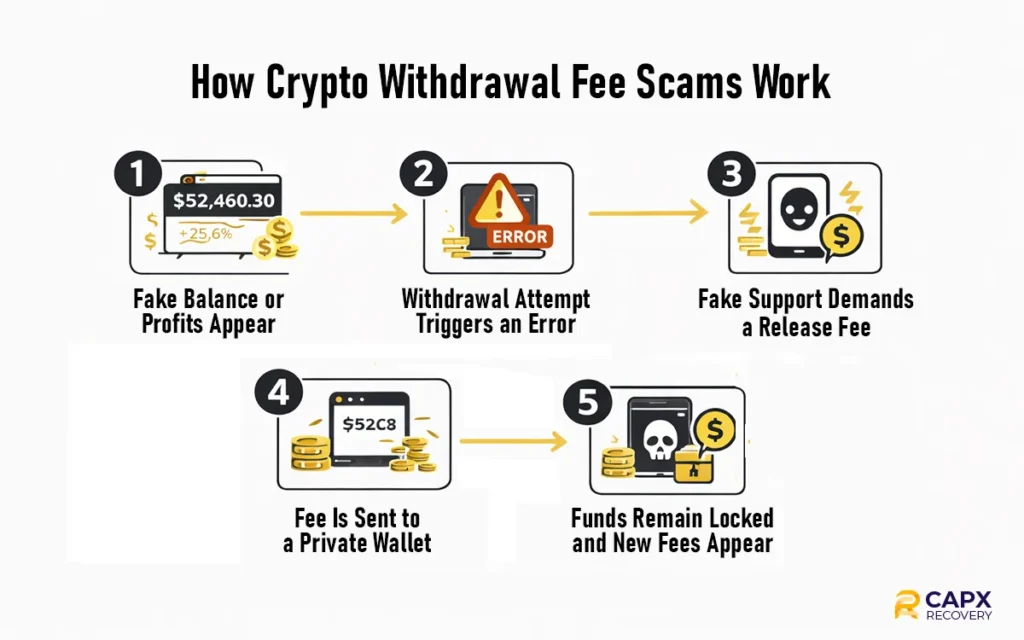

How the scam typically unfolds:

- A balance or profit appears in a dashboard

- Withdrawal attempt triggers an error or warning

- Support claims a fee is required to release funds

- The fee is paid directly to a wallet address

- Withdrawal remains blocked, and new fees appear

Once the first payment is made, victims are often pushed deeper with additional charges until they stop paying or realize the scam.

Why Withdrawal Fee Scams Are So Effective?

Withdrawal fee scams do not rely on complex hacking. They rely on psychology. Scammers understand how people react when they believe their money is almost within reach.

The first trigger is urgency. Victims are told the withdrawal window is limited or the account will be frozen permanently. This pressure reduces skepticism and pushes for fast decisions. The second trigger is sunk cost. Once someone has already deposited funds or paid one fee, paying another feels like the only way to avoid a total loss.

Scammers also borrow language from real crypto systems. Network congestion, compliance checks, liquidity thresholds, and gas fees all sound legitimate to everyday users. Many victims know withdrawals can fail, so a fee does not immediately raise alarms.

Finally, the scam keeps victims isolated. Conversations move to private chat, email, or messaging apps. Support appears responsive and professional, but there is no accountability. By the time doubts surface, funds have already been transferred beyond recovery.

Common Types of Withdrawal Fee Scams

Withdrawal fee scams show up in several forms, but the structure stays the same. A visible balance, a blocked withdrawal, and a demand for upfront payment.

1. Fake crypto exchanges

These are professionally designed websites that mimic real trading platforms. Users see charts, balances, and even fake transaction histories. When they try to withdraw, the platform claims a liquidity, verification, or processing fee is required.

2. Impersonated wallet support

Scammers pose as customer support for popular wallets or exchanges. Victims are told their wallet is flagged or stuck due to a network issue and must pay a fee to unlock withdrawals.

3. Telegram and Discord investment groups

Private groups promote high-return trading signals or arbitrage strategies. Profits appear quickly inside a fake dashboard, but withdrawals are blocked until a fee is paid.

4. Romance investment scams

A personal relationship builds first. Then, crypto investing is introduced. Once funds grow on a fake platform, withdrawal fees are used to extract more money.

5. Fake recovery services

After an initial loss, victims are contacted by “recovery experts” who promise to retrieve funds for an upfront charge. This is a second scam targeting already affected users.

Each version looks different on the surface, but the demand for an advance payment is the common red flag.

Real-World Examples of How Victims Get Trapped

Example 1: The profitable exchange that won’t pay out

A user discovers a new trading platform through social media. The site looks polished and shows fast gains after a small deposit. When the user tries to withdraw, support responds instantly. The account is “temporarily restricted” due to low liquidity. A one-time liquidity fee is required. After payment, a new issue appears. Now it’s a compliance fee. The balance keeps showing, but withdrawals never work.

Example 2: Fake wallet support intervention

A victim searches online after a failed withdrawal and clicks a sponsored support link. The agent claims the wallet is stuck due to a network verification error. The fix requires sending a small amount of crypto to activate the withdrawal channel. Once paid, communication slows. Then a second fee is requested for gas optimization.

Example 3: The recovery trap after a loss

After realizing they were scammed, a victim posts in a forum. A “recovery specialist” reaches out privately and promises to trace the funds. An upfront service fee is required. No recovery ever happens, and the victim loses more money.

These cases follow the same pattern. Hope is used as leverage right before the loss becomes final.

Early Warning Signs of a Crypto Withdrawal Fee Scam

Most victims realize something is wrong only after multiple payments. These warning signs usually appear much earlier.

- You are asked to pay a fee before accessing your own funds

- Fees must be sent separately instead of being deducted from your balance

- The reason for the fee keeps changing

- You are pressured to act quickly or face account closure

- Support avoids public channels and insists on private messaging

- No verifiable company address, license, or legal entity exists

- The platform is not listed on major app stores or trusted review sites

- Withdrawal rules are vague or missing from official documentation

One red flag alone should trigger caution. Multiple red flags almost always confirm a withdrawal fee scam.

Withdrawal Fee Scam vs Legitimate Crypto Fees

One reason these scams work is that real crypto transactions do involve fees. The difference is how those fees are charged and who controls them.

| Feature | Legitimate Crypto Fees | Withdrawal Fee Scam |

| Who charges the fee | Blockchain network or verified exchange | Scammer posing as a platform |

| How the fee is applied | Automatically deducted from the balance | Paid separately upfront |

| Transparency | Public fee schedule or network data | Vague, changing explanations |

| Payment destination | Platform system or network | Personal wallet address |

| Result after payment | Withdrawal completes | New fees are demanded |

Legitimate exchanges never ask users to send money outside the platform to unlock withdrawals. If a platform claims your funds exist but cannot deduct fees directly, the funds are not real or are not under your control.

How Big Is the Problem? 2025–2026 Data and Trends

Crypto withdrawal fee scams are no longer a niche fraud. They are now one of the most common loss patterns reported by retail crypto users.

Consumer protection data shows that advance-fee crypto scams recovery continue to grow year over year. Reports compiled by agencies like Federal Trade Commission and CFTC highlight a sharp rise in cases where victims were shown fake balances and asked to pay fees to access their own funds. These losses often go unreported because victims feel embarrassed or believe recovery is impossible.

Two trends stand out going into 2026. First, scammers are using AI to impersonate support agents, automate conversations, and generate professional-looking dashboards. Second, more scams now combine multiple stages, starting with fake trading profits and ending with withdrawal fees, tax charges, and fake recovery offers.

As crypto adoption expands, scammers are shifting from brute-force theft to psychological extraction. Withdrawal fee scams sit at the center of that shift because they exploit trust, timing, and the belief that the money is almost there.

What To Do Immediately If You’ve Paid a Withdrawal Fee?

The moment you realize you may have paid a fake withdrawal fee, stop engaging. Continuing the conversation almost always leads to more losses.

First, cut off contact with the platform, support agent, or individual involved. Do not argue or try to negotiate. Scammers use conversation to regain control and push new fees.

Next, preserve everything. Save wallet addresses, transaction hashes, screenshots of the platform, chat logs, emails, and payment instructions. This information matters if exchanges or investigators get involved.

If you sent funds from a centralized exchange, contact that exchange immediately and flag the transaction as fraud. Timing matters. In some cases, accounts receiving funds can be frozen.

Then report the scam to consumer protection and financial regulators. Agencies such as the Federal Trade Commission and CFTC track these cases and use reports to disrupt larger scam networks.

Finally, warn others if the scam happened in a group or community. It will not recover your funds, but it can prevent more victims from falling into the same trap.

Can You Recover Funds From a Withdrawal Fee Scam?

Recovery is difficult, but it is not always impossible. The outcome depends on speed, where the funds were sent, and whether any regulated platforms were involved.

If the payment passed through a centralized exchange, there is a small window where action can help. Exchanges can sometimes freeze receiving accounts if fraud is reported quickly and supported with evidence. This is rare, but it does happen.

Once funds move through private wallets or are swapped across chains, recovery becomes far more complex. Blockchain transactions are irreversible by design. At that point, recovery shifts from reversing transactions to tracing them. Blockchain analysis can sometimes identify cash-out points, especially when scammers reuse wallets or interact with known services.

It is important to stay realistic. Anyone promising guaranteed recovery or fast results in exchange for an upfront fee is almost certainly running another scam. Legitimate recovery efforts focus on documentation, reporting, and containment, not promises.

Legitimate Recovery Options vs Fake Recovery Services

After a withdrawal fee scam, many victims are targeted again. This second wave often causes more damage than the original loss.

Legitimate recovery paths:

- Exchange intervention when funds are touched on a centralized platform

- Law enforcement reports for large or cross-border losses

- Blockchain analysis to trace fund movement and identify exit points

These options take time and come with no guarantees. They focus on investigation, not instant results.

Common fake recovery tactics:

- Promises of guaranteed fund recovery

- Requests for upfront service or “activation” fees

- Claims of insider access to exchanges or law enforcement

- Pressure to act fast before funds “disappear forever”

| Recovery Option | When It Helps | Red Flags |

| Exchange support | Funds sent from or to a CEX | Slow but legitimate |

| Law enforcement | Significant financial loss | Long timelines |

| Blockchain analysis firms | Tracing fund movement | No guarantees |

| Instant recovery services | Never | Upfront fees |

If recovery requires paying first, it is not recovery. It is the same scam wearing a different mask.

How to Report a Crypto Withdrawal Fee Scam?

Reporting matters, even if recovery feels unlikely. Individual reports help authorities spot patterns, shut down scam infrastructure, and warn others faster.

Start with the platform you used to send funds. If a centralized exchange was involved at any stage, report the transaction as fraud and provide full documentation. Exchanges rely on user reports to flag wallets and suspend related accounts.

Next, file a complaint with the consumer and financial regulators. Agencies such as the Federal Trade Commission, CFTC, and national investor protection bodies collect crypto scam data and share it with enforcement partners.

If the loss is significant, report the incident to local cybercrime units or financial crime divisions. Provide transaction hashes, wallet addresses, URLs, and communication records. The more complete the report, the more useful it becomes for investigations.

Reporting does not just document a loss. It helps disrupt scam networks that rely on silence to keep operating.

How to Avoid Withdrawal Fee Scams Going Forward?

Avoiding withdrawal fee scams comes down to a few habits that remove most of the risk upfront.

Only use established exchanges and wallets with a public track record. If a platform cannot be independently verified, assume the balance you see may not be real. Before depositing, look for clear withdrawal rules, published fees, and real user reviews outside of social media.

Never pay to unlock your own money. Legitimate crypto fees are deducted automatically. The moment someone asks you to send funds separately to process a withdrawal, step away.

Be cautious with private messages, especially on Telegram, Discord, dating apps, or social platforms. Most withdrawal fee scams begin in private conversations where there is no public accountability.

Finally, slow the process down. Scammers rely on urgency. Taking time to verify, research, or ask for a second opinion often breaks the spell before money is lost.

Frequently Asked Questions

Why can’t the fee be deducted from my balance?

If a platform claims it cannot deduct fees from available funds, the balance is likely fake or not under your control.

Can blockchain transactions be reversed?

No. Blockchain transactions are irreversible by design. Recovery focuses on freezing accounts or tracing funds, not reversing payments.

How long does crypto scam recovery take if it works?

When recovery is possible, it often takes months, not days. Fast recovery promises are a major red flag.

Why do scammers ask for multiple fees?

Each fee is designed to extract more money once trust and hope are established. There is always another issue after the first payment.