Advance fee scams are no longer clumsy emails promising easy money. Today, they look like polished investment platforms, confident advisors, and dashboards that show steady profits day after day. The pitch feels professional. The numbers look real. And the promise is always the same: guaranteed returns with little or no risk.

That promise is exactly what makes these scams so effective.

In early 2026, advance fee scams are among the fastest-evolving forms of investment fraud. They now target crypto investors, AI trading enthusiasts, forex traders, and even people exploring passive income for the first time. Scammers use realistic websites, live chat support, fake compliance documents, and carefully staged profits to build trust before asking for one thing: an upfront fee to unlock your money.

Once that fee is paid, another fee follows. Then another. By the time victims realize what’s happening, the funds are gone, and the platform disappears.

This guide breaks down how advance fee scams are evolving, why guaranteed returns still fool smart investors, and what these schemes actually look like behind the scenes.

What Is an Advance Fee Scam and How Do They Work?

An advance fee scam is a scheme where an investor is told they must pay a fee before they can access their own funds. The investment itself is usually fictitious. The profits shown on the platform are manufactured. The only real transaction is the money the victim sends out.

These scams often start convincingly. The dashboard shows steady gains. A support agent responds quickly. In some cases, small withdrawals are processed to build trust. The situation changes the moment a larger withdrawal is requested.

That is when the fees begin.

The “Fees” Scammers Commonly Invent

To make the demand feel legitimate, scammers rotate official-sounding charges and present them as non-negotiable.

- Withdrawal or fund release fees

- Liquidity unlock or processing fees

- Wallet verification or gas fees

- Compliance or anti-money laundering fees

- Tax clearance or capital gains charges

The tax angle is especially effective. Victims are told their account is flagged and cannot be unlocked until taxes are paid upfront to a specific wallet. This plays on fear and confusion around financial rules. In reality, legitimate platforms never collect taxes this way. A deeper explanation of how fake tax demands are used in financial scams is covered in this guide on tax fraud.

The core pattern never changes. You are asked to send money in order to receive money. Once a fee is paid, a new obstacle appears, and the cycle continues until the victim stops paying or the scammers disappear.

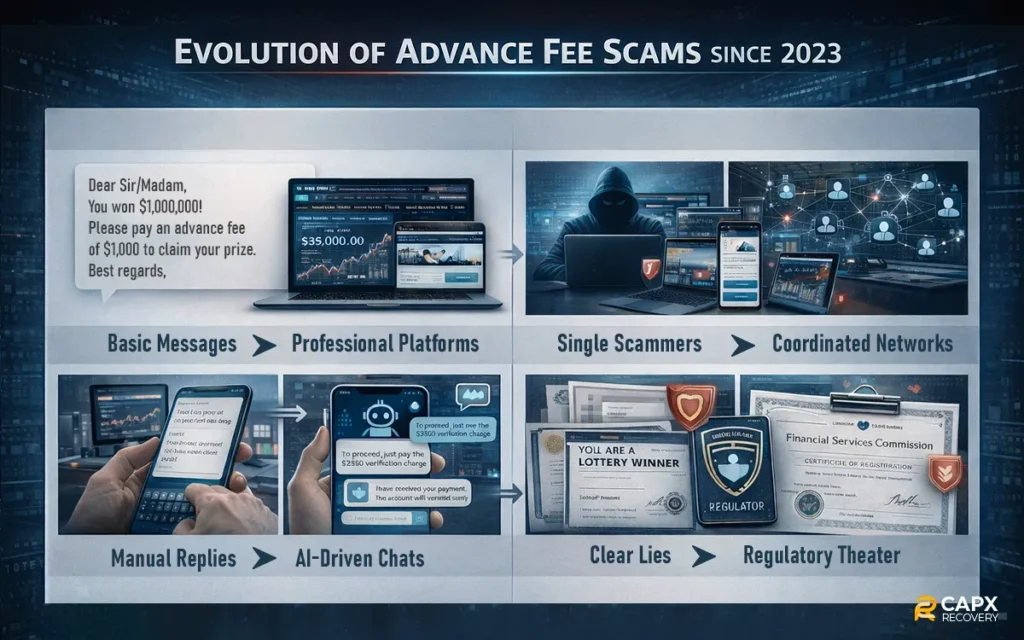

How Advance Fee Scams Have Evolved Since 2023?

A few years ago, advance fee scams were easier to spot. Poor grammar. Random emails. Obvious lies. That version of the scam still exists, but it is no longer the main threat.

Since 2023, these schemes have become far more sophisticated.

Scammers now build full investment ecosystems designed to feel real over time. Instead of rushing victims, they focus on credibility, patience, and emotional control. Many scams now run for weeks or even months before any fee is mentioned.

Here’s what has changed.

From Simple Messages to Full Platforms

Scams have moved beyond direct messages into polished websites and apps.

- Professional-looking trading dashboards

- Live price charts copied from real markets

- Account balances that update daily

- Fake transaction histories and profit logs

To an average investor, these platforms look indistinguishable from legitimate services.

From Solo Scammers to Organized Networks

Modern advance fee scams are rarely run by one person.

- Dedicated “account managers” handle victims

- Separate support teams respond to questions

- Different wallets are used for each fee request

- Scripts are shared to maintain consistency

This structure makes the operation feel stable and trustworthy.

From Obvious Lies to Regulatory Theater

One of the biggest shifts is how scammers use fake compliance.

- Forged licenses and registration numbers

- Fake audit reports and legal notices

- Claims of regulation in well-known jurisdictions

- Threats of account suspension for non-payment

These tactics are designed to pressure victims into paying quickly while making the demand seem official.

From Human Scripts to AI Assistance

In 2025 and early 2026, scammers increasingly rely on AI tools.

- Chat responses that sound polished and calm

- Personalized messages based on victim behavior

- Faster adaptation when doubts are raised

The result is a scam that feels less like manipulation and more like customer service.

This evolution is why advance fee scams continue to succeed. They no longer rely on tricking people once. They rely on slowly convincing them that they are already inside a legitimate system.

Why Guaranteed Returns Remain a Powerful Trap?

The promise of guaranteed returns is the oldest trick in investment fraud, and it remains one of the most effective. Even experienced investors fall for it when the presentation looks professional, and the profits appear consistent.

The reason is psychological.

Guaranteed returns remove uncertainty. They replace risk with confidence and doubt with reassurance. When a platform shows steady daily gains and claims losses are impossible, it short-circuits the instinct to question what’s really happening.

How Scammers Make “Guaranteed” Look Believable

Modern scams rarely promise absurd profits up front. Instead, they frame guarantees in subtle ways.

- Fixed daily or weekly percentage gains

- “Risk-free” or capital-protected strategies

- Claims of proprietary AI or insider systems

- Assurances that market volatility does not matter

These statements are often paired with dashboards that update in real time, reinforcing the illusion of stability.

Why Early Profits Are Part of the Trap?

Many victims report being able to withdraw small amounts early on. This is not a sign of legitimacy. It is a calculated move.

- Small withdrawals build trust

- Profits are shown as proof of success

- Victims are encouraged to reinvest and scale up

- Emotional commitment increases with each step

Once the invested amount grows, withdrawals suddenly require fees, approvals, or compliance checks.

The Reality Behind the Promise

There is no legitimate investment that can guarantee returns. Markets move. Strategies fail. Risk cannot be eliminated.

When a platform insists profits are certain, it is not offering safety. It is removing your ability to question what comes next.

Common Platforms Used in Modern Advance Fee Scams

Advance fee scams are no longer tied to one channel. Scammers spread across platforms where investors already spend time and where trust builds quickly. The goal is to meet people in familiar spaces, then quietly move them into controlled environments.

Here are the most common platforms being used in early 2026.

Fake Crypto Exchanges and Investment Dashboards

These are custom-built websites or apps that imitate real exchanges.

- Clean interfaces with live price feeds

- Account balances that update daily

- Fake trade histories and profit charts

- Withdrawal screens are designed to trigger fee demands

Once funds are deposited, the platform controls everything the investor sees.

Messaging Apps and Private Investment Groups

Telegram, WhatsApp, and similar apps play a central role in modern scams.

- Private groups sharing “wins” and screenshots

- Fake success stories from planted accounts

- Direct access to an “advisor” or “mentor”

- Pressure to move conversations off public platforms

Many advance fee scams begin inside these groups before victims are directed to a fake platform. This pattern is common in Telegram-based schemes.

AI Trading Bots and Copy Trading Apps

AI has become a powerful credibility booster.

- Claims of automated, emotion-free trading

- Copy trading tied to a “top-performing” account

- Consistent returns regardless of market conditions

In reality, the trading activity is either simulated or completely fabricated.

Cloned Forex and Investment Broker Sites

Some scams copy real brokers almost exactly.

- Slightly altered domain names

- Reused license numbers from legitimate firms

- Fake customer support chat windows

To most users, these sites look authentic unless checked carefully.

What all these platforms have in common is control. Once you are inside their system, scammers decide what you see, when you can withdraw, and how many fees stand between you and your money.

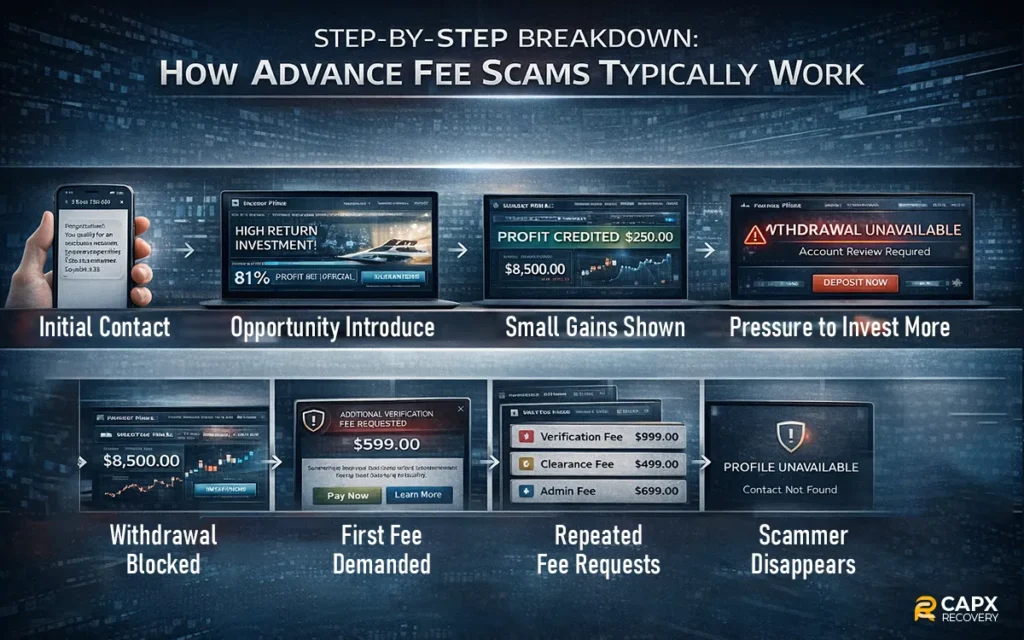

Step by Step Guide of How an Advance Fee Scam Works

Most advance fee scams follow a predictable pattern. The details change, but the structure stays the same. Understanding the sequence makes it easier to spot the scheme before real damage is done.

Step 1: Initial Contact

The first interaction often happens through social media, messaging apps, or online communities. It may start as a casual conversation, a trading tip, or an invitation to join a private investment group.

The approach feels personal, not promotional.

Step 2: Introduction to the Opportunity

After trust is established, the victim is introduced to a platform, advisor, or automated system. Screenshots of profits and success stories are shared to create credibility.

At this stage, there is no pressure.

Step 3: Small Investment and Early Gains

The victim is encouraged to start with a small amount. The platform shows quick, consistent gains. In some cases, a small withdrawal is allowed to reinforce trust.

This is the hook.

Step 4: Encouragement to Scale Up

Once confidence is high, the victim is urged to invest more. The messaging shifts to opportunity and urgency. Missing out becomes the risk.

Step 5: Withdrawal Is Blocked

When a larger withdrawal is requested, the tone changes. A problem appears. The account is flagged. Funds are temporarily locked.

Step 6: The First Fee Demand

A fee is required to release the funds. It may be labeled as a tax, processing, or compliance charge. The payment is usually requested from an external wallet.

This is where many victims hesitate.

Step 7: Escalation and Repeated Fees

After the first payment, new issues emerge. Each one requires another fee. The amounts often increase. Communication becomes more urgent and emotional.

Step 8: Disappearance

Once payments stop or doubts grow, the platform freezes, support goes silent, or the account is deleted entirely.

This sequence is deliberate. It is designed to turn initial trust into commitment, and commitment into repeated payments.

Why Crypto and AI Investing Are Prime Targets in 2026?

Crypto and AI investing sit at the center of modern advance fee scams. Not because investors are careless, but because these areas combine complexity, hype, and fast-moving narratives. That mix makes it easier for scams to blend in.

Scammers go where confusion already exists.

Complexity Creates Cover

Blockchain transactions, smart contracts, gas fees, and AI models are difficult to verify for most people. Scammers use technical language to sound credible and discourage questions.

- Fake explanations for locked funds

- Technical excuses for delayed withdrawals

- Jargon that overwhelms rather than informs

When investors feel unsure, they are more likely to trust the “expert” guiding them.

Cross-Border Systems Limit Accountability

Crypto platforms often operate across jurisdictions. Scammers exploit this by claiming regulatory protection in foreign regions while remaining unreachable.

- No clear company address

- Vague licensing claims

- Support teams that avoid direct answers

This makes victims believe recovery is impossible unless fees are paid immediately.

AI Narratives Add Authority

AI has become a shortcut to trust.

- Claims of emotion-free decision-making

- Promises of consistent performance

- Screenshots of algorithm-driven trades

Most investors cannot verify how an AI system actually works, so the results are accepted at face value.

Market Volatility Is Used as an Excuse

When markets move unpredictably, scammers frame delays and restrictions as normal.

- Volatility requires temporary locks

- Liquidity issues justify fees

- Risk management is used to explain restrictions

In reality, volatility is just another tool to keep funds trapped.

Crypto and AI are not the problem. The problem is how easily uncertainty can be weaponized when technology outpaces understanding.

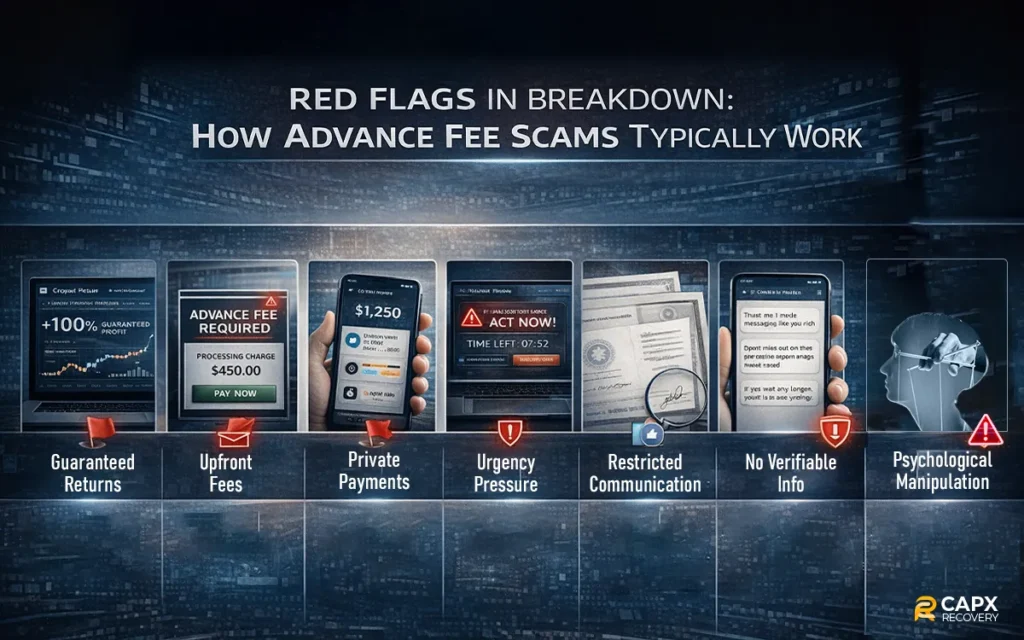

Warning Signs Many Investors Ignore

Even as awareness grows, many advance fee scams succeed because the warning signs don’t look dramatic in isolation. Each red flag is small. Together, they tell a clear story.

The problem is that scammers rely on timing and emotion to keep investors from stepping back and connecting the dots.

The Most Common Red Flags

- Guaranteed or fixed returns regardless of market conditions.

- Requests to pay fees before withdrawals are processed.

- Payments are directed to private wallets instead of being deducted automatically.

- Pressure to act quickly to avoid account suspension.

- Communication is restricted to private chats or messaging apps.

- Refusal to provide verifiable company details.

Another overlooked signal is how conversations are managed. Scammers often guide discussions away from facts and toward reassurance, urgency, or authority. This is not accidental. It is a classic manipulation tactic designed to lower resistance and override logic. A deeper breakdown of how these psychological techniques are used in financial scams can be found in this guide on social engineering scams.

Why These Signs Are Easy to Ignore?

Each step is framed as normal. Fees are described as routine. Delays are blamed on systems or regulations. Doubts are met with calm explanations that sound reasonable in the moment.

By the time investors realize something is wrong, they are already emotionally and financially invested.

Spotting one red flag early is often enough to stop the scam. The challenge is recognizing it before trust takes over.

Key Statistics and Trends from 2025 to Early 2026

Advance fee scams are not slowing down. They are scaling. Reports from consumer protection agencies, banks, and fraud monitoring firms all point to the same pattern: investment scams now cause more financial losses than almost any other fraud category.

The shift is not just about volume. It is about how efficiently these scams extract money.

What the Data Shows

Across 2025 and into early 2026, several trends stand out.

- Investment scams remain the leading source of reported fraud losses worldwide

- Crypto-related investment fraud accounts for the largest share of those losses

- Advance fee tactics are increasingly combined with fake trading platforms

- AI-generated content is now widely used to impersonate advisors and support teams

- Average victim losses continue to rise as scams run longer before collapsing

Many victims report losing money over weeks or months, not days. The longer the scam runs, the higher the final loss tends to be.

Scam Growth Snapshot

| Metric | Direction of Trend |

| Crypto investment scam reports | Rising year over year |

| Advance fee fraud cases | Increasing across regions |

| Use of AI in scam communication | Rapid growth |

| Average loss per victim | Steadily increasing |

| Time before detection | Longer than previous years |

Why Do These Trends Matter?

The combination of professional platforms, delayed fee triggers, and psychological manipulation means fewer people realize they are being scammed until significant damage is done.

This is no longer a fringe problem affecting only inexperienced investors. The data shows a clear shift toward targeting educated, tech-savvy individuals who believe they are making informed decisions.

Understanding these trends is critical because they explain why awareness alone is no longer enough. Scams are adapting faster than most investors expect.

How to Respond if You Have Been Targeted by a Scam

If you suspect an advance fee scam, speed matters. Not because you can fix it by paying more, but because continuing contact often leads to deeper losses.

Here’s what actually helps.

Stop the Damage First

The priority is to prevent further payments and limit exposure.

- Stop all communication with the platform or “advisor”

- Do not pay any additional fees, no matter the reason given

- Do not share IDs, screenshots, or wallet access

- Avoid arguing or trying to recover funds from the scammer

Once you push back, scammers often escalate pressure or disappear. That reaction itself is a signal.

Preserve Evidence

Even if recovery is uncertain, documentation matters.

- Save transaction hashes and wallet addresses

- Take screenshots of the platform, balances, and messages

- Record dates, amounts, and payment instructions

- Keep copies of emails, chats, and links

This information is critical for reporting and any next steps you choose to take.

Report the Scam

Reporting helps protect others and creates a record.

- Notify the exchange or wallet provider used for payment

- Report the scam to local consumer protection agencies

- Flag the website, app, or social account involved

Avoid services that promise guaranteed recovery. Many victims are targeted a second time by recovery scams that follow the same advance fee pattern.

The hardest part is stopping. Once payments end, the scam loses its power.

How to Protect Yourself from Advance Fee Scams

Avoiding advance fee scams is less about spotting one perfect red flag and more about building a few hard rules you do not bend.

These habits make scams much easier to spot early.

Practical Rules That Actually Work

- Never trust guaranteed or fixed returns

- Never pay fees to unlock or release your own funds

- Be wary of investments introduced through private messages

- Verify platforms independently, not through links provided

- Use well-known, regulated services whenever possible

- Step back when urgency or secrecy is pushed

One simple check stops many scams cold. Ask yourself why a legitimate platform would need you to send money separately to access money that already belongs to you.

Slow Decisions Reduce Risk

Scammers rely on momentum. Taking time breaks their control.

- Pause before increasing investment amounts

- Get a second opinion from someone outside the situation

- Research the platform name plus the word “scam”

- Walk away if answers feel rehearsed or evasive

Real investments still exist tomorrow. Scams do not.

Protection is not about being suspicious of everything. It is about refusing to bypass basic financial logic, no matter how convincing the presentation looks.

Final Thoughts: Awareness Is the Only Real Defense

Advance fee scams have evolved into polished, patient, and psychologically precise operations. They do not rely on obvious lies anymore. They rely on trust, consistency, and the promise of certainty in uncertain markets. Guaranteed returns are not a benefit. They are a warning.

The more professional an opportunity looks, the more important it is to slow down and question how it actually works. Technology will keep changing. Scam tactics will keep adapting. The one constant is this: no legitimate investment asks you to pay money just to access what is already yours.Staying informed, skeptical of guarantees, and willing to walk away is still the strongest defense investors have. For more help on avoiding advance fee scams, visit CAPX recovery.

Frequently Asked Questions About Advance Fee Scams

Can legitimate platforms ever charge withdrawal fees?

Legitimate platforms deduct standard fees automatically from your balance at the time of withdrawal. They do not ask you to send money separately to a private wallet.

Why do scammers allow small withdrawals early on?

It is a trust-building tactic. Letting victims withdraw small amounts makes the platform feel real and lowers resistance to investing more later.

What if the platform claims fees are required due to regulations?

That is a common excuse. Real regulatory costs are handled internally or deducted automatically. External fee payments are a red flag.

Can victims recover funds lost to advance fee scams?

Recovery is difficult and never guaranteed. Anyone promising guaranteed recovery, especially for an upfront fee, is likely running a second scam.

How quickly should you act if you suspect a scam?

Immediately. Stop communication, stop payments, and preserve evidence. Delays usually lead to additional losses.